Sprint 1: Money, Bitcoin & Perpetuals

Study updates for week May 30 - June 6

Quicklinks

This being the maiden voyage of a currently tempestuous market climate - red candles, Musk tantrums and BTC v. ETH maxis at war - I thought it would be a good opportunity to dial back and review the origins of digital cash or cryptocurrencies. The why we do what we do.

What is Money?

An economy is a series of activities consisting of an exchange of demand and supply. In a modern economy, these exchanges are facilitated by a tangible resource called money.

It is more helpful to first understand money in terms of what it does, than what it looks like. Money serves as a Means of Exchange or unit of account, Store of Value, representation of Debt, and reserve of Wealth. This extends into a discussion properties of money: fungibility, limited supply, divisibility etc.

The next chapter to discuss is on how a financial system and monetary policy is used to support an economy. I thought it was interesting to point out that the fiat system is essentially a circulating issuance of debt by a central bank - a ponzi that endless borrows from person to person. Fiat money does not hold intrinsic value - see the What is Money? argument again. From discussing this with some peers, I found this to be the quintissential decoupling to help the lay person cross the chasm and open themselves into the concept of a digital currency.

While these ideas aren’t new in the age of cryptocurrencies, but I’d like to get to stage that I can confidently posit them with the right citations.

The first few clasess in Blockchain & Money by Gary Gensler (Goldman Sachs, SEC chairman) explores this very nicely. I recommend looking into the following as well to help build your own intuition:

- 15.S12 Money, Ledgers & Bitcoin

- Mises Institute - Principles of Sound Money

- ScienceNews: Conflict reigns over the history and origins of money

- Mark Yusko: Crypto, Legacy and Value on Bankless

What is Bitcoin?

More appropriately: what is a digital currency, and how does it compare to the current monetary system?

The layperson (trades) cryptocurrencies for their price action, and we should accurately distinguish them from investors. The original design for Bitcoin (and its predecessor Hashcash) explores much more than value appreciation based on a fixed supply. A lot of Bitcoin’s inherent value derives from tamper-proof mechanisms in its technical application (cryptography, cost functions, Proof-of-Work) and economical design (Expected Utility Theory, Gambler’s Ruin).

I have a lot more appreciation for POW as a choice in security, despite its impact in ecological footprint. It moves the burden of proof, however, towards building more energy-efficient technology, instead of a knee-jerk rejection to Bitcoin altogether. Despite living in an age of information, it seems like the common person thinks in simplified and absolute terms - one or the other. I’d like to see sufficient argument against POW itself. Bringing up the argument of carbon footprint does not dispute the merits of a trustless, decentralized money, and we can do better to avoid whatabout-ism logical fallacy.

I recommend reading the Bitcoin whitepaper several times, taking each turn to focus on the technical and financial designs separately. Use the POW visual explanation to help map the process of minting and transacting cryptocurrencies to the fiat system, keeping in mind that once again, paper money is still an issuance of debt and representation of labored value.

- Nakamoto, Satoshi: Bitcoin whitepaper

- Blockchain 101: a visual demo video

- Build your own blockchain playground

Derivatives: Perpetuals

Perpetuals are non-expiring versions of futures contracts that distinctly allows traders to (1) open positions with high leverage and (2) get short exposure without owning the asset. Inverse perps also allow for price speculation using holdings in a given asset instead of holding fiat. They’re native to cryptocurrency exchanges, with the common DEXes being dydx, futureswap, Perpetual Protocol and MCDEX

Some good introduction to perpetual contracts:

This post by Weiting Chen makes two points for perpetual swaps:

- profiting against price drops during a locked, staking period.

- profiting against IL.

Retail DeFi users should exercise a fair amount of caution with advanced techniques as they tend to apply only for significantly large principals especially when taking into account confounding variables such as gas fees, liquidity pool size and slippage at the time of execution. In the above example, I noticed that there is at least an assumption that the LP yield stays at 3-digit % over duration of lockup. Otherwise, since the net profit has to mostly come from LP gains in the bull scenario - the given 17% ($53k) is overestimated.

But it is a good experiment to run because the high APY LPs are typically digital dollar pairs and IL is a huge cost for small baskets.

Perp Protocol runs on xDAI and would make the cost of experiment significantly lower. More strategies here:

- BTC Perpetuals on dYdX

- YFI perps on Perpetual Protocol

Lend to Borrow to Lend: the Degen game

Rather late to the MATIC-Aave-Curve tumbling machine, but I’ve always preferred to exercise caution over aping. These resources are straightfoward to get anyone started at compounding interests with practically zero fees.

- Taiki Maeda: youtube

- Stakingbits: Yield Farming with Aave on Polygon

This strategy is mostly valid until June 14th after which a second liquidity mining program with the equivalent 0.5% supply allocation is diluted to Apr 2022.

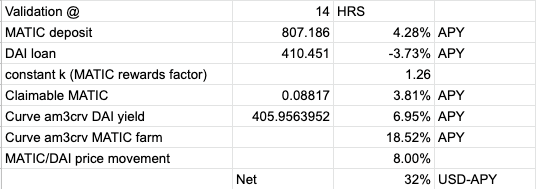

I ran through the numbers and am looking at a net 32% APY @ 1 MATIC = 1.60 USD. It includes some assumptions which I still can’t access for example, the MATIC reward APY% for DAI borrows against the MATIC reward APY% for MATIC deposits, which I denoted as a constant k - I’m assuming that to be linear, but that’s a very wild approximation.

There are other variables to consider, and how to respond to MATIC price action and continue to profit. More in the next post.

There are some more Degen 101 materials I covered as well, but I’ll call out these unassorted ones for now:

- APY.vision: How to Choose a Liquidity Pool

- yvBOOST - Ceazor’s Snack Sandwich

- SUSHIswap Overview

The Right to Privacy

The right to a private conversation was a natural right. If privacy is outlawed, only outlaws will have privacy

by the author of PGP. The rest of his pieces on PGP are also good, quick reads to remind ourselves that technology such as the internet, firearms and encryption do not wield moral complexities. Humankind should take it as a challenge to coordinate themselves.

** This retrospective only covers highlights. You can find the rest of the new weekly reading list here